The Road to College: Supporting Traditionally Underserved Students

School librarians can be a vital resource, helping students and families research prospective schools, find financial aid and scholarship opportunities, and learn about possible future careers.

|

Students at the Queens (NY) Library, which offers many college prep resources.Courtesy of Queens (NY) Library |

Planning for college isn’t easy for any student, but for traditionally underserved students, it can be an especially daunting task.

Planning for college isn’t easy for any student, but for traditionally underserved students, it can be an especially daunting task.

Students from low-income and BIPOC families and those striving to be the first generation to attend college are often less likely to be provided with information to plan for college. In a recent survey of underserved students, well under half had access to resources like college fairs or courses to explore possible careers, and 91 percent say they wanted more guidance from their high school about their path after graduation.

While teachers and college counselors play an important role in this work, school librarians can also be a vital resource, helping students and their families research prospective schools, find financial aid and scholarship opportunities, and learn about possible future careers.

School librarians seeking ways to help their underserved students prepare for life after high school can learn from several models used around the country, from public library programs to nonprofits and innovations by fellow school librarians.

|

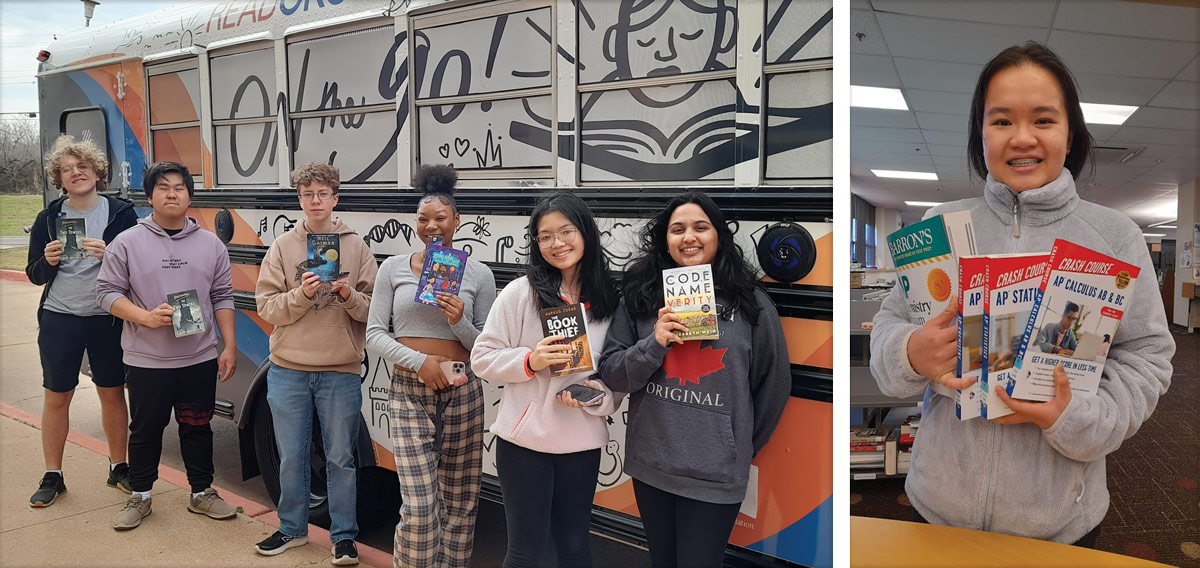

From left: An Oklahoma City nonprofit, ReadOKC, sponsors bus visits to public schools.

|

Resources in schools, libraries, and beyond

Suzanne Sutton has been the library media specialist at Classen School of Advanced Studies High School in Oklahoma City for three years. Over that time, Sutton and her library have become an almost de facto extension of the college counseling program.

Sutton believes that school librarians are always looking for ways to partner with other staff members, and college counselors are often-overlooked partners. “Collaborating with counselors is not just another way to advocate for your space but also to show you’re a team player and support students, which is what it’s all about really.”

Sutton’s library space often serves as the host for events like college and university rep visits or FAFSA information nights for parents. Sutton also reads college admissions essays on occasion.

“I see myself as an additional support, especially because our counselors change each grade level. But students are going to have the same librarian every year, so they can come to me with questions and I can at least point them in the right direction,” Sutton says.

Coming from a low-income background herself, Sutton is acutely aware of what it’s like for some of her students who “don’t know what you don’t know,” as she puts it, and she enjoys helping “demystify things” for them.

She is mindful to listen to the needs of her students, who come from widely different socioeconomic and ethnic backgrounds.

One of the loudest demands she heard in her first year in the library was a need for test preparation materials. “Not everyone can drop money on a test prep book,” Sutton says. So her budget now includes funds to update materials every year, including for the ACT and AP exams, and a subscription to an online test prep service.

All of it, Sutton says, “helps break down that barrier and students have access to resources that will make them more confident when they take those tests.”

School libraries can also take some tips from the resources their public library counterparts offer.

For the last few years, the Queens Public Library in New York City has run a comprehensive college readiness program, with everything from college fairs, a database for scholarships, and a Job and Business Academy to help students develop résumés and find professional opportunities.

Norman Delgado-Camacho is the library’s high school and college readiness coordinator. The resources offered across three Queens Library teen centers have become very popular among students, he says, especially those “looking to get ahead of the curve, and looking for somewhere outside of school and home to ask questions where we don’t hold judgment and just are happy to answer questions.”

While the program doesn’t track participants based on income, Delgado-Camacho says it has attracted many first-generation and undocumented students, all looking for support navigating the application process.

Those students in particular often face additional challenges translating information and navigating the education system with their families, says Ayesha Cammaerts, executive director of the Boston Opportunity Agenda, a public-private partnership that focuses on removing systemic barriers for historically oppressed and economically disadvantaged students.

A major issue is recognizing the additional workload many students carry beyond school.

“We hear from many high school students from low-income families that they work to support their families and struggle to manage the demands of school with work pressure and schedules,” Cammaerts says.

She often hears a particular suggestion to alleviate the pressure on those students as they navigate the college application process: “[Provide] more flexible high school schedules and curriculum to make it more manageable to balance work demands.”

|

A student participating in a Dakota Dreams career exporation summer camp.Courtesy of the South Dakota Board of Regents |

Career readiness

Cathy Mueller, executive director for the nonprofit Mapping Your Future, says career planning should begin as early as eighth grade. Launched in 1996, Mapping Your Future is a collaborative public-service project of the financial aid industry that provides free resources for students and families to explore careers and prepare for college, including how to pay for it.

|

“We want to encourage students to explore, to think about their interests, to go to career camps, and to do research on their own as well as in school,” she says. “It’s important to think about a career, and librarians can help with that a lot because it requires research.”

Many U.S. students are exploring careers earlier than they used to. Since the pandemic, states around the country have placed greater emphasis on preparing students for college and careers, in large part thanks to emergency education relief funds. In South Dakota, a coalition of the state’s public technical colleges and universities, along with the South Dakota Department of Education and the Board of Regents, has created “Our Dakota Dreams,” a hub of resources to help students from elementary school to incoming college age prepare for their future.

One of the most impactful parts of the program is the career exploration summer camps for rising seventh and eighth grade students.

“The purpose is to let middle school students explore career interests and options with faculty from both universities and tech colleges,” says Molly Weisgram, system academic grants program manager for the South Dakota Board of Regents. “The camps are an opportunity for kids to better get to know themselves, put on different hats, and figure out what they like and what they don’t like.”

Hosted on South Dakota college campuses and partnered with a local technical college, the camps allow students to not only experience possible careers through hands-on learning but also to see which colleges or universities may provide the best pathway to their future.

[Also read: "SLJ Reviews Gale Presents: Peterson’s Test and Career Prep Database"]

In their first summer in 2021, the camps were slated to serve 150 students, but doubled that number after receiving more than 600 applications. This summer, the program remains hugely in demand, with nine camps for 900 students. The program has also prioritized students from districts that are Title I or that were deemed to have high absenteeism during the COVID-19 pandemic.

Weisgram says the initiative has also helped students better understand the differences between universities and technical colleges, distinctions that college counselors at high schools said were confusing for many students.

“Getting to be on both of those campuses and hear from faculty for both of those institutions is helpful, because students are able to see the different opportunities and have a reference point they wouldn’t have had otherwise,” Weisgram says.

Knowing that they have options is important for this generation of students. A recent survey from ECMC Group found that 63 percent of teens are open to options other than a four-year degree, but that only 13 percent felt prepared to choose a post–high school path.

In Oklahoma City, Sutton sees students showing more interest in alternate pathways after high school, stemming in large part from the high tuition costs associated with traditional four-year colleges and the subsequent heavy toll of student loans.

Sutton says that many high school students in her district take advantage of free job training programs offered through Metro Tech, a school established in 1979 to provide career and technology education to students in Oklahoma City.

Another program is called Early Start, offered through the Oklahoma City Community College for concurrent students. Classen School is one of a handful of schools participating in the pilot program that will see students graduate high school with an associate’s degree.

“I think our state is seeing that not everyone is going to be able to afford the exorbitant costs of tuition so are looking for alternative solutions,” Sutton says. “I appreciate that these programs and partnerships are going to be really helpful for our students.”

|

Student Oscar Torres with Portsha Franklin, his coach from Success Boston,

|

Financial aid and a rocky FAFSA rollout

Even with exposure to careers and support applying to college, once students are accepted, they and their families still face a major hurdle—figuring out how to pay for it.

“The biggest question is probably understanding how financial aid works,” says Mueller. “Money is the hardest issue for people to understand.”

Comprehension starts with learning the difference between options, from state aid to federal aid, institutional aid, and private funding.

Since 1997, Mueller’s Mapping Your Future has provided a host of financial resources for students and their families, including tips and tools for completing the Free Application for Federal Student Aid, or FAFSA.

For decades, FAFSA has been the main path for families to qualify for scholarships, grants, and federal student loans. This year, an overhaul known as the FAFSA Simplification Act was meant to make it even easier for more students to receive funding. Instead, it proved to be a debacle, with technical challenges and other problems delaying families from finding out if they qualified for aid. Colleges didn’t receive student financial information until March, instead of January. Although many schools ended up extending their typical May 1 decision day to as late as June, that still left families and students having to make difficult financial choices out of fear of losing a spot at a dream school.

Others simply didn’t even bother to apply. According to the National College Attainment Network, the percentage of the high school class of 2024 that has completed the FAFSA remains well off from last year, down 13.5 percent at the end of May.

FAFSA changes were also meant to increase student eligibility for Pell Grants, which are awarded to undergrads who have the most financial need. According to the U.S. Department of Education’s FAFSA website, 610,000 new students are estimated to be eligible for a Federal Pell Grant in the 2024–25 award year.

A survey on the FAFSA rollout completed by ScholarshipOwl, an AI-powered website that connects students to scholarships, found that 24 percent of respondents received less aid than they had expected, while 70 percent were only offered loans.

Despite the continued FAFSA challenges, experts say they are optimistic that the process will truly be simplified next year, and that this year’s problems shouldn’t deter families from filling it out, as FAFSA is still one of the most important steps in planning how to pay for college.

“It’s important for students to fill out the FAFSA and not let it be a hurdle,” Mueller says. “Until they fill it out, they don’t know what they will receive for federal aid. It also qualifies them for state aid, and institutions need it for scholarships, both need-based and merit-based, and some private scholarships use it as well.”

Mueller says if students and families need help, there are free resources available through the Department of Education, as well as nonprofits like Mapping Your Future, and that families should never pay for help to complete the FAFSA.

Queens Library’s Delgado-Camacho says the new FAFSA rollout proved challenging not only for students, but even for trained support staff like him. Looking for additional help, Delgado-Camacho partnered with CUNY’s Financial Aid Support Team, which in addition to providing specialized financial aid coaches to help with FAFSA, has also helped students complete tuition assistance through the DREAM Act for Non-Citizens.

Delgado-Camacho is optimistic that now that the majority of FAFSA changes have been implemented, the process will truly be simplified.

“There have been challenges,” he says. “But now we’re in a position where we can offer expert help in the library.”

Andrew Bauld is a freelance education reporter.

RELATED

The job outlook in 2030: Librarians will be in demand

The job outlook in 2030: Librarians will be in demand

ALREADY A SUBSCRIBER? LOG IN

We are currently offering this content for free. Sign up now to activate your personal profile, where you can save articles for future viewing

Add Comment :-

Be the first reader to comment.

Comment Policy:

Comment should not be empty !!!